Understanding the Claims Adjuster Role

Embarking on a career as a claims adjuster is a rewarding path, and a well-crafted cover letter is your key to unlocking the door. This guide provides the roadmap to create a compelling cover letter, even without direct experience. Claims adjusters play a crucial role in the insurance industry, investigating claims, assessing damages, and negotiating settlements. They act as the primary contact between the insurance company and the claimant. Understanding this role is the first step in crafting a targeted cover letter that resonates with potential employers. By demonstrating comprehension of the claims adjuster responsibilities, you set yourself apart.

Key Responsibilities of a Claims Adjuster

Claims adjusters are responsible for a variety of tasks, including investigating insurance claims to verify the extent of the loss or damage. They examine policy details to determine if the claim is covered and assess the value of the damages. Furthermore, they interview claimants, witnesses, and other relevant parties to gather information. They prepare reports detailing their findings and negotiate settlements with claimants. Often, they must be able to interpret complex legal documents and insurance policies. A solid understanding of these responsibilities is crucial to showcase your potential in your cover letter.

Skills Needed for a Claims Adjuster

Success as a claims adjuster requires a blend of soft and hard skills. Strong analytical and problem-solving abilities are essential for assessing claims and making fair decisions. Excellent communication and interpersonal skills are necessary for interacting with claimants and other professionals. Negotiation and conflict-resolution skills are critical for reaching settlements. Attention to detail, organizational skills, and the ability to work under pressure are also highly valued. Highlighting relevant skills in your cover letter will demonstrate your suitability for the role. Consider including examples that emphasize these skills in your previous experiences, even if they are not directly related to claims adjusting.

Why a Cover Letter Matters

In the competitive job market, a cover letter is your chance to make a strong first impression and differentiate yourself from other candidates. It’s your opportunity to demonstrate your enthusiasm for the role and explain why you are a good fit for the company. Unlike a resume, which summarizes your experience, a cover letter allows you to articulate your career goals, showcase your personality, and highlight how your skills align with the specific requirements of the claims adjuster position. This becomes even more important when you are trying to enter a field without experience, as it enables you to explain your motivation and illustrate how your transferable skills will benefit the employer.

Highlighting Transferable Skills

Even without direct claims adjusting experience, you likely possess transferable skills that are highly valuable in this field. These might include: customer service, analytical skills, problem-solving abilities, communication, negotiation, organization, and time management. Think about your past roles and identify examples where you demonstrated these skills. For example, if you have customer service experience, describe how you handled difficult situations, resolved complaints, and provided excellent service. If you have strong organizational skills, showcase how you managed multiple projects or tasks simultaneously. These transferable skills are key to creating a competitive cover letter.

Researching the Company and Job

Thorough research is vital before you start writing your cover letter. Understanding the company’s values, mission, and recent news is important. Explore the company’s website, social media profiles, and any available industry publications. Pay close attention to the job description. Identify the specific requirements, skills, and qualifications the employer is seeking. Use this information to tailor your cover letter, showing how your qualifications align with the company’s needs. Address the hiring manager by name if possible; this demonstrates your initiative and attention to detail.

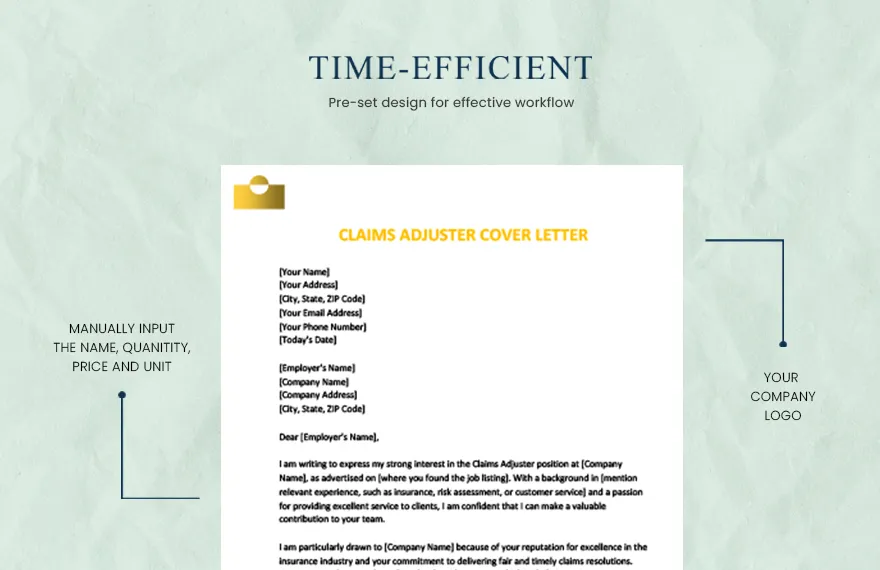

Cover Letter Structure for No Experience

Structuring your cover letter effectively will enhance readability and make it easy for the hiring manager to find the information they need. A well-organized cover letter demonstrates professionalism and attention to detail. Start with a clear and concise format and a strong opening to capture the reader’s attention. Be sure to incorporate the right components within the cover letter body to maximize your chances of getting noticed. This will allow you to present your qualifications and potential in a way that is easily understood.

Header and Contact Information

Begin your cover letter with a professional header that includes your name, address, phone number, and email address. If you know the hiring manager’s name and title, include it in the header. If not, use a general salutation. Ensuring that your contact information is easy to find enables the hiring manager to contact you easily. A professional header is the first step in creating a positive impression. Consider formatting that is easily readable, with contact information aligned to the right or left.

Opening Paragraph

The opening paragraph is your first chance to grab the reader’s attention. Express your interest in the claims adjuster position and briefly state where you found the job posting. You should immediately mention your enthusiasm for the company and the specific role, and you should highlight the skills and qualifications you possess that align with the job requirements. Keep it concise and engaging to make a strong first impression and encourage the reader to continue reading. You can mention the value you bring, such as your ability to learn quickly and your eagerness to contribute to the company’s success.

Body Paragraph 1 Transferable Skills

In the first body paragraph, focus on your transferable skills. Select 2–3 skills most relevant to the claims adjuster role. Provide specific examples from your previous experiences, even if they are unrelated to claims adjusting. For example, if you have customer service experience, describe a time when you resolved a complex customer issue. If you have strong analytical skills, give an example of a time you analyzed data and made a key decision. Quantify your achievements whenever possible using numbers and metrics to show impact. This section is crucial to demonstrate how you can meet the requirements of the role.

Body Paragraph 2 Passion and Interest

This paragraph should demonstrate your passion for the claims adjuster role and the insurance industry. Explain why you are interested in this specific career path. Share any personal experiences or reasons that motivated your interest. Mention any relevant training or education you’ve completed, even if it’s not directly related to claims adjusting. Show your knowledge of the insurance industry, such as industry trends or challenges. By showcasing enthusiasm and a genuine interest in the field, you will impress the hiring manager with your commitment and dedication.

Body Paragraph 3 Company Alignment

In this paragraph, illustrate how your values and goals align with the company’s mission and culture. Mention anything that has particularly attracted you to the company, such as their commitment to customer service, their innovative approach, or their positive reputation. Explain how you can contribute to their success based on your skills, and the research you’ve done on them. Aligning yourself with the company’s values showcases your genuine interest and increases your chances of making a favorable impression. Tailor your cover letter to the specific company whenever possible to show that you have done your homework.

Closing Paragraph

The closing paragraph should reiterate your interest in the position and thank the hiring manager for their time and consideration. Restate your key qualifications and express your eagerness to discuss the opportunity further. Include a call to action, such as stating that you are available for an interview. Maintain a professional tone and use a courteous closing, such as “Sincerely” or “Best regards.” A strong closing reinforces your interest and makes it easier for the hiring manager to contact you. Ensure that you have proofread the entire document before submitting it.

Proofreading and Formatting

Before submitting your cover letter, carefully proofread it for any typos, grammatical errors, or formatting inconsistencies. Ensure that the letter is well-organized, easy to read, and visually appealing. Use a professional font and maintain consistent spacing. Ask a friend or family member to review your letter for any errors you might have missed. A polished cover letter shows attention to detail, which is essential for a claims adjuster. Ensure there are no spelling errors or grammatical issues.

Tailoring Your Cover Letter

Customizing your cover letter for each job application is crucial. Avoid using a generic letter; personalize it to the specific requirements of the position and the company. Take the time to research the company and job description to identify the key skills and qualifications the employer seeks. Tailor the content to match the company’s requirements, including any keywords mentioned in the job posting. This shows the hiring manager that you have taken the time to understand their needs.

Using Keywords from the Job Description

Carefully review the job description and identify keywords related to skills, qualifications, and experience. Strategically incorporate these keywords into your cover letter to demonstrate you meet their requirements. Keywords help your application get past applicant tracking systems (ATS) and show hiring managers your relevant skills. However, don’t just stuff keywords into the text; use them naturally within the context of your sentences. Prioritize keywords related to analytical skills, communication, negotiation, and problem-solving.

Showcasing Enthusiasm and Willingness to Learn

Even without direct experience, you can impress the hiring manager with your enthusiasm and eagerness to learn. Express your passion for the claims adjuster role and the insurance industry. Highlight your willingness to learn new skills and take on challenges. Mention any relevant training or certifications you are pursuing or plan to obtain. Showcase your proactive approach to professional development. This will show that you are a quick learner and are eager to contribute to the company.

Common Mistakes to Avoid

Avoiding common mistakes can significantly improve your cover letter’s effectiveness. Be attentive and careful about the details. By avoiding these errors, you will present a polished application, maximizing your chances of getting the job.

Generic Letters

Avoid using a generic cover letter that is not customized to the specific job or company. Hiring managers can easily spot generic letters, and they often discard them. Tailor your letter to each job application, emphasizing the skills and experience most relevant to the role and the company. Research the company and demonstrate your genuine interest in working there.

Typos and Grammatical Errors

Typos and grammatical errors are unprofessional and can create a negative impression. Proofread your cover letter carefully before submitting it. Use a grammar checker and have someone else review it as well. Attention to detail is critical in the claims adjuster role, so make sure your cover letter reflects this quality. Errors can suggest a lack of attention and make the candidate look unprofessional.

Lack of Research

Failing to research the company and the job description shows a lack of initiative and interest. Demonstrate your interest by mentioning specific details about the company and how you can contribute. Research the company’s values, mission, and recent news. Highlight how your skills and experience align with their needs.

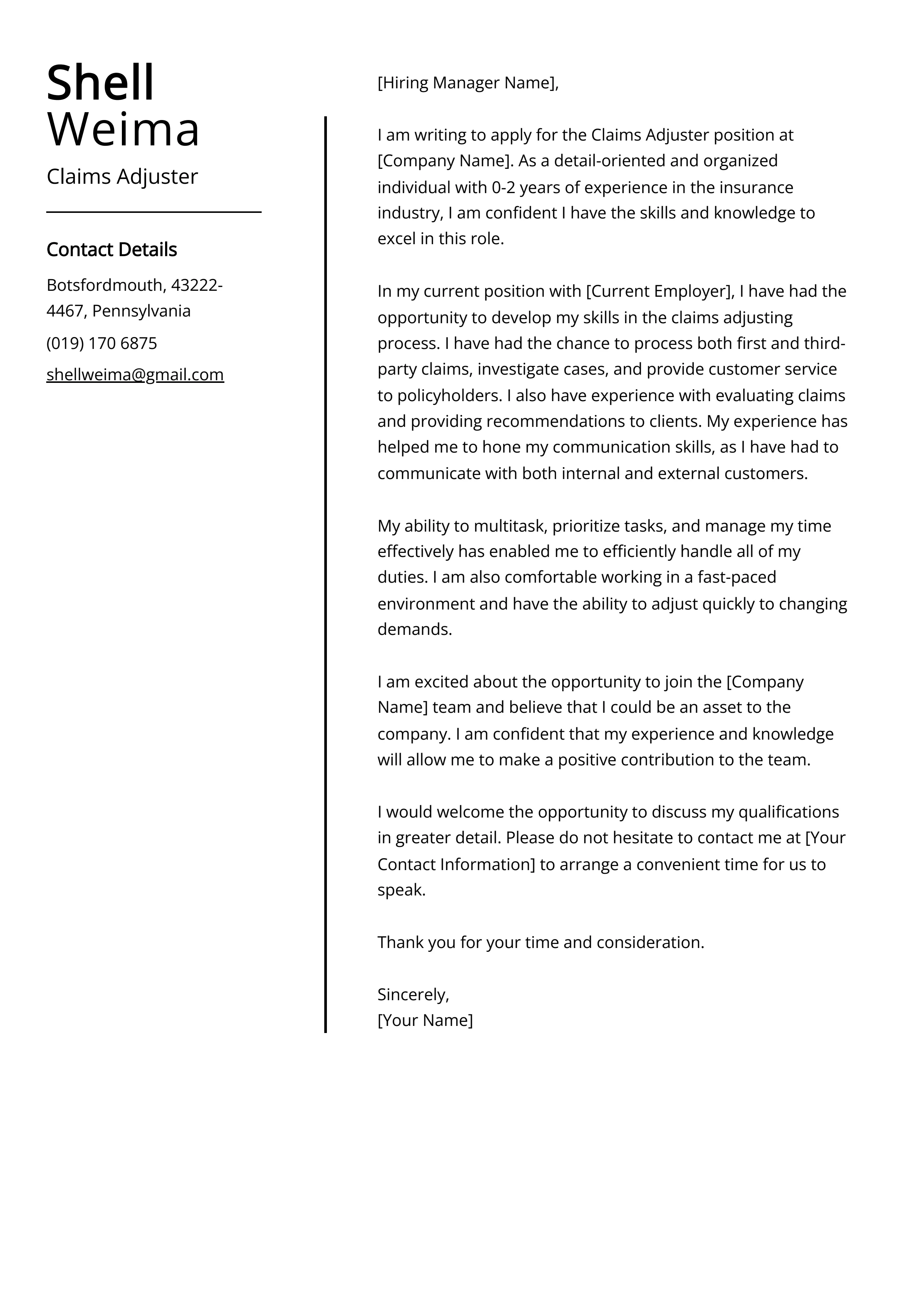

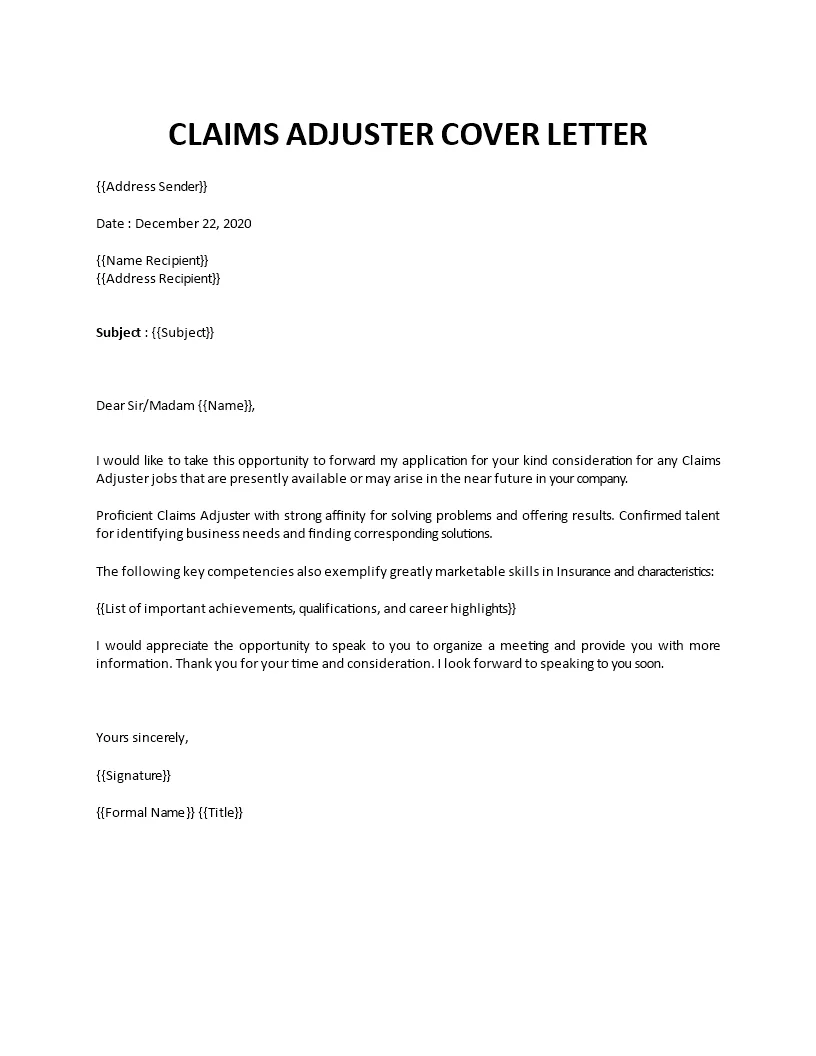

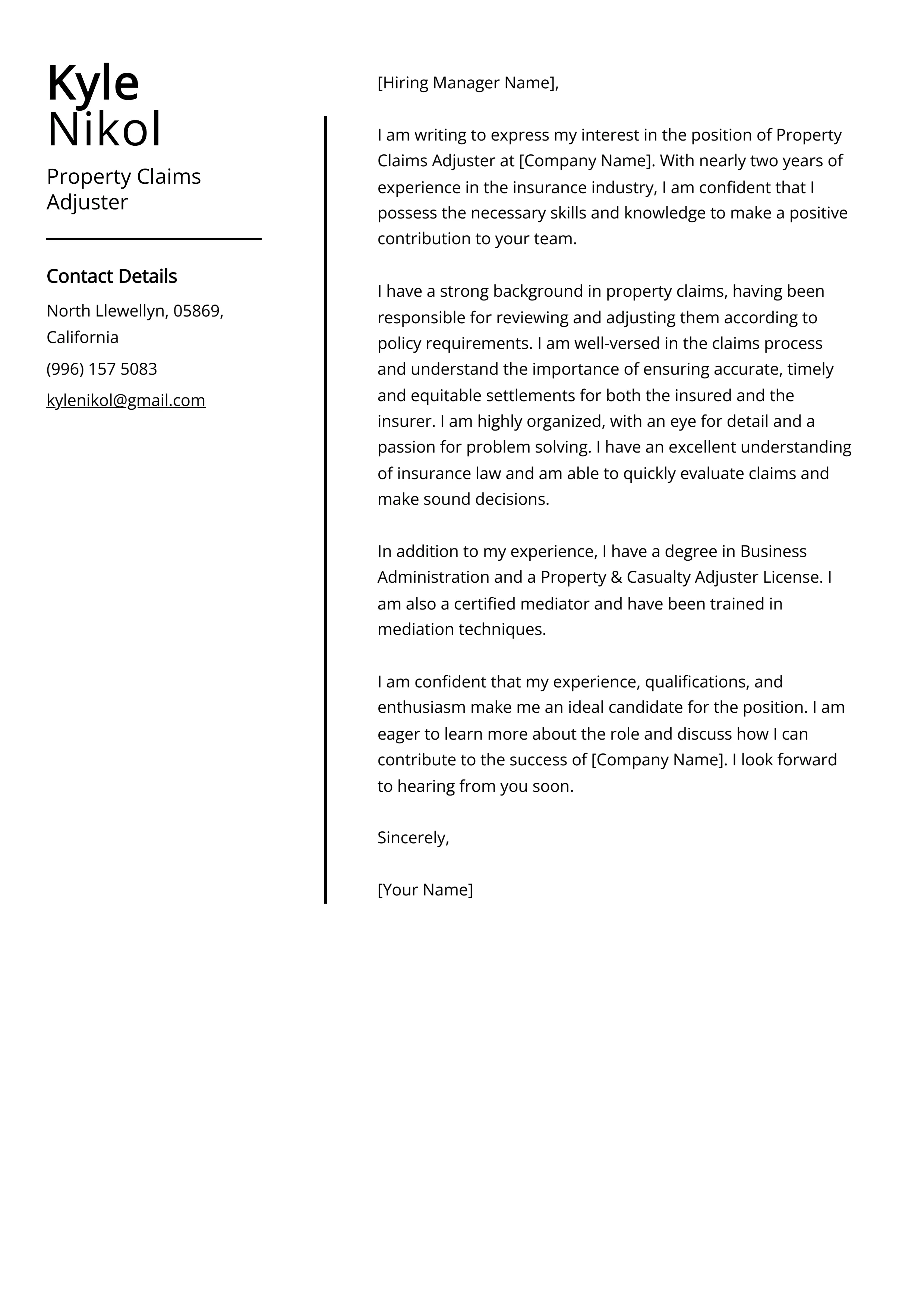

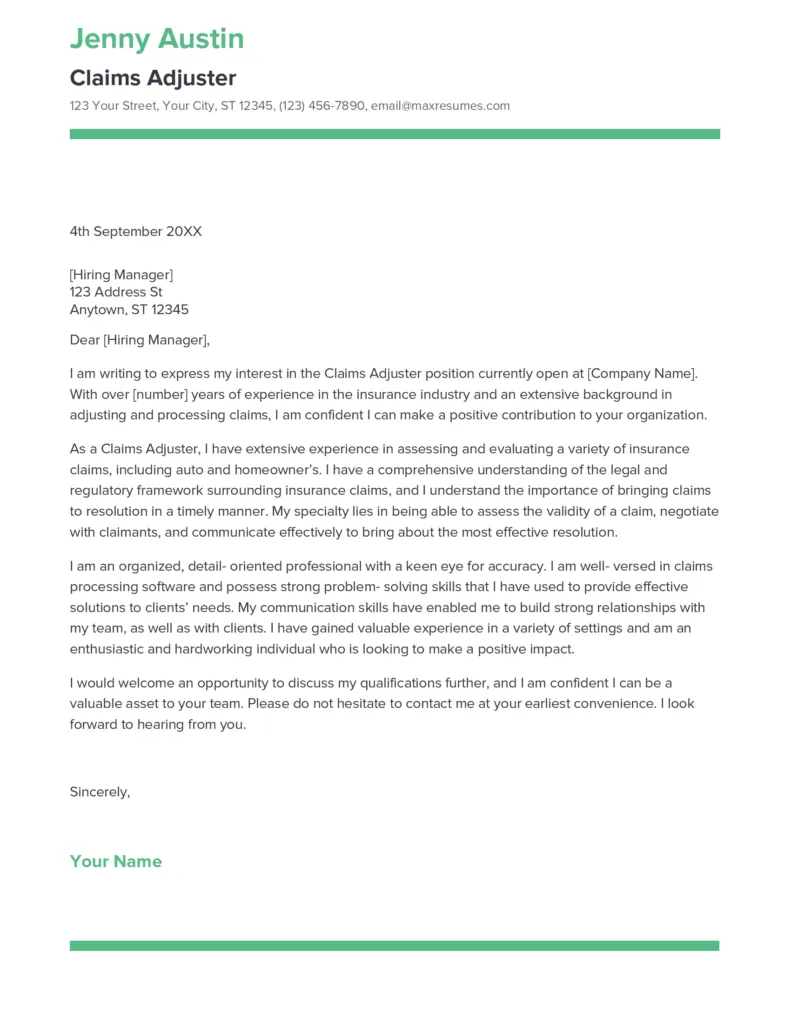

Cover Letter Examples for Claims Adjuster

Reviewing example cover letters can give you valuable insights into formatting, content, and tone. Find examples tailored for individuals with no experience, as this will give you a better understanding of how to highlight transferable skills. Pay attention to how the examples are structured and the language used. However, remember to customize the examples to match your own background and the specific job requirements. Use examples as a guide but make your letter unique.